Conjoint Analyses

Always the right conjoint design for optimizing willingness to buy and willingness to pay

Our portfolio includes the entire range of conjoint methods for the optimal market orientation of your products and services. On your behalf, we realize virtually any conjoint design with our award-winning survey software, advise you on sample size, conjoint analysis and market simulation based on conjoint data.

Determine willingness to pay and product configuration with Conjoint

A conjoint analysis -also called conjoint measurement – can be used in cases where products or services are to be designed to meet market requirements and to be focused on customer utility. When used properly, this conjoint method can show which product attributes are crucial to the customer’s decision to buy, where possible purchase decision thresholds lie (e.g., with the price), and also the optimal price for the product. Conjoint analysis is one of the central methods of price research. In addition, market simulations can be used to forecast which product configuration offers the best market prospects, or the extent to which new products might adversely affect the client’s other products which are already established on the market.

Thus, conjoint studies are especially good at answering “What if…” questions. This method is therefore well-suited for providing management and marketing departments with a substantiated tool for making decisions.

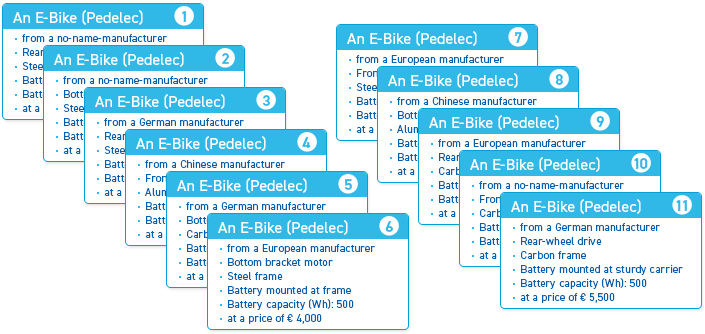

“Cards” with stimulus examples as used in a survey on E-Bike

The following conjoint methods are the most commonly used:

Wide range of applications for conjoint measurement

Conjoint analyses can be used for a very wide variety of tasks in market research (such as product development, or the provision of information to marketing and advertising departments). In order to use this method, it must be possible to break down the product or service in question into attributes relevant to the purchase decision, and at least one of these attributes must be able to incorporate some degree of alteration. In addition, conjoint measurement also requires that it be possible to offer the survey participant a realistic picture of the alternative products or services to choose from.

In conjoint design, great care must be taken when selecting the product attributes and their specific attribute levels. Mistakes made here will have a serious effect on the validity of the results.

Sample size of a conjoint study

The sample size of a conjoint study is a function of the homogeneity of the range of opinions given by the survey participants, as well as of the size of the basic underlying target group. The more homogenous the range of opinions, and the smaller the population size, the smaller the sample can be. In studies with highly specific and very small target groups, samples with 20 to 30 cases may be sufficient. In cases where there is a wide range of opinions, at least 300 people should be surveyed, particularly when segmentation according to product utility is to be performed.

Conjoint analysis: Utility values measure the importance of characteristics and characteristics

All conjoint methods deliver comparable data, so-called utility values. Ultimately, these shed light on how important the individual attributes are in terms of the decision to buy. In addition, they show which specific levels of these attributes are most desired, and how great their benefit is compared to other levels of these attributes.

Conjoint analysis plus cluster analysis

Segmentation according to utility, produced using cluster analysis, provides information on the breakdown of the target group. This often allows for more specifically targeted communication with the market.

Market simulations based on conjoint data

If suitable attributes are present, market simulations can be carried out using the conjoint data obtained. These allow statements to be made as to how the client’s own market share will change when certain alterations are made to the product itself or its price. By means of the online tool MASIM, it is possible to provide the data and programs to the client so that simulations can be performed on-site at the client’s premises.

With the MASIM tool from the ADABOX you can also carry out simulations independently.